Medifast Stock: Winning Profits In The Business Of Losing Weight (NYSE:MED)

Table of Contents

Grandbrothers/iStock via Getty Images

Investment thesis

The main reason why weight loss or dieting programs are not successful is due to the failure of participants to follow through with the program consistently. As this article pointed out, “it probably matters less which plan you pick (whether low-carb, low-fat, or something in between) than whether you stick with it“.

Medifast, Inc (NYSE:MED)’s value propositions aim to directly address this pain point with its coach-centric business model. Instead of simply selling weightless products with purportedly hyped-up results using costly marketing efforts, Medifast’s weight loss solution relies on coaches to ensure clients who subscribed to its weight loss programs “stick with it” in the long run.

Financially, if we compare MED’s financial profile with other peer companies, they are superior by most measures, suggesting they are succeeding with this coach-centric business model.

With most of MED’s customers on subscription services (about 90% of the customer base), it provides the business with a consistent stream of recurring revenue, suggesting the current financial success is likely to be sustainable.

Customers are unlikely to end their subscriptions due to the network effect created between the clients, product offerings, and coaches which we will discuss in later sections.

The company is currently undervalued and presents a good investment opportunity.

Company Overview

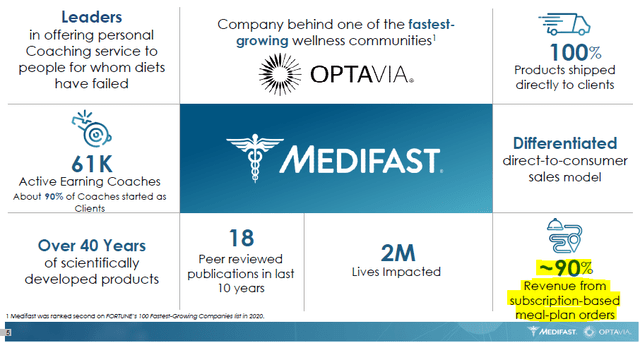

Medifast is a wellness company that produces, distributes, and sells products and services to help people lose weight under the OPTAVIA brand. Products and services under the OPTAVIA brand include:

- “OPTAVIA Essential Fuelings” – these are processed food options that are filled with vitamins, minerals, and proteins to help clients archive their weight loss objectives.

- “Optimal Weight and Health plans” – These are clinically proven plans by health professionals to help clients develop healthy eating habits to help achieve their weight-loss objectives.

- “OPTAVIA Coach Business” – Clients who are successful in achieving weight loss objectives can become coaches where they are compensated based on their success in helping clients achieve weight loss objectives and mentoring new coaches. Coaches advise clients on how to effectively utilize the fuelings and health plans to achieve their weight loss objectives.

To put it in simpler terms, the company’s Fuelings are the “tools” required for clients to succeed. Weight and health plans are the “strategies” to use these tools. Coaches help to ensure clients utilize both the tools and strategies correctly and effectively based on their own successful experience.

Since OPTAVIA coaches succeeded with the same products consumed by their clients, they offer more credibility in their coaching services compared to externally hired fitness coaches.

Recurring Revenue

From the latest Investor Presentation, about 90% of its revenues come from direct-to-consumer, subscription-based meal-plan orders.

Medifast (MED) Investor Presentation Q4 2021

This helps the company sustain a reliable source of consistent income. As mentioned by the management during the latest earnings call, “As of the end of 2021, over 90% of our revenue is subscription-based and 100% of our orders are direct to consumer, which drives strong, consistent growth in revenue and profits”.

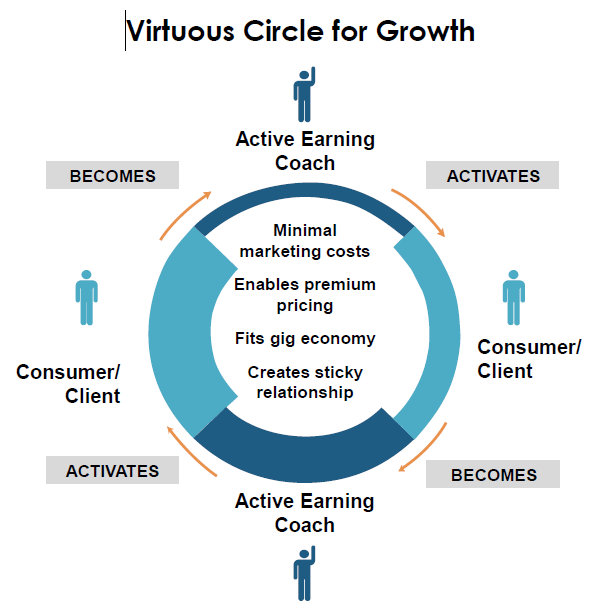

Network Effect and Economies of Scale

This diagram taken from the Investor Presentation deck illustrates how the coaching program adds value by creating a growth cycle that benefits both coaches and clients.

As highlighted by the management during the earnings call, “At OPTAVIA, we’re building a deeply connected community, optimized by a powerful network effect rather than a fluctuating direct sales model. We believe that we have a compelling value proposition and that our platform is highly scalable, fortified by our significant investment in technology and infrastructure.”

This is how it works:

Medifast (MED) Investor Presentation Q4 2021

- It started with Clients of Medifast who became successful in achieving weight loss and are motivated to pay it forward by becoming coaches to help other clients achieve the same results.

- Coaches receive benefits as documented in the “INTEGRATED COMPENSATION PLAN”. Clients benefits by receiving personalized assistance in weight loss. A win-win situation is developed between coaches and clients.

- With more value-added assistance from coaches, more clients became successful. With more successful clients, the cycle goes back to point 1 where more of them become coaches to encourage others to succeed using Medifast’s products and services.

The virtuous cycle of points 1 to 3 helps to pass on a common marketing narrative of “how to succeed using Medifast’s products and services” with a minimal added cost in Sales and Marketing. This is because coaches effectively double up as sales distributors using their own success stories to attract more clients.

Without the need to hire large numbers of dedicated sales staff, this allows the company to reap the cost advantage from economies of scale. (Increasing sales without increasing marketing costs)

Overall, the sticky relationship between clients, coaches, and MED’s products also translates to a “network effect” where clients are dependent on MED’s products and coaching services to maintain their success in weight loss.

Brand Recognition

The brand of Optavia which is owned by Medifast has been recognized for its accolades in financial and product quality:

- Medifast has been ranked 23rd place in one of the best mid-cap companies by Forbes, as of 18 Jan 2022. This is primarily “based on earnings growth, sales growth, return on equity and total stock return for the latest 12 months available and over the last five years”.

- Fortune magazine has a similar ranking for “100 Fastest-Growing companies” in 2021, and Medifast ranked 22nd.

- U.S. News has “ranked 40 diets for their effectiveness in short term weight loss based on input from a panel of diet, nutrition, and health experts”. Medifast’s OPTAVIA brand is ranked 2nd on this list.

This is an attestation of the strength behind the Optavia brand.

Financial Overview and Competitive Analysis

From the company’s latest annual report, the company identified the following as its competitors:

“Medifast’s identified publicly-traded peers and competitors in the general health and wellness diet industry include USANA Health Sciences Inc., WW International, Inc. (formerly Weight Watchers International, Inc.), Nature’s Sunshine Products Inc., Herbalife Nutrition Ltd., Simply Good Foods Co., The Hain Celestial Group, Inc., BellRing Brands, Inc., and Beyond Meat, Inc.“

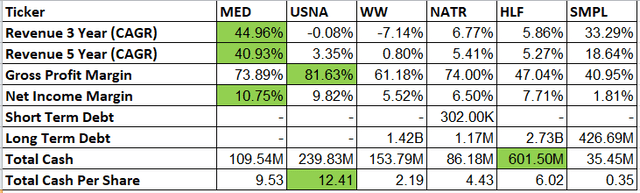

For simplicity, we will just compare the financials of MED with the first 5 mentioned in the list:

- USANA Health Sciences Inc. (USNA)

- WW International, Inc. (WW)

- Nature’s Sunshine Products Inc. (NATR)

- Herbalife Nutrition Ltd. (HLF)

- Simply Good Foods Co. (SMPL)

Financial Figures Compiled from Seeking Alpha

We can gather the following insights:

- MED has the highest top-line growth in the comparison list.

- MED has the highest bottom-line margin in the comparison list.

- In terms of gross margin, MED can be considered to be in second place, tied with NATR at 74% when rounded off to a whole number.

- Only 2 companies on the list are debt-free and MED is one of them.

- In terms of cash per share, it is only second to USNA.

High-growth companies usually need to incur heavy costs to sustain growth. But for MED, this is not the case as observed from the fact that the bottom line margin is also the highest in the comparison list. And all these were achieved in a healthy net cash position.

Overall, Medifast’s transformation to a coach-centric model with recurring income as the main source of revenue appears to be working, allowing it to rise above its competitors in terms of financial performance.

Valuation

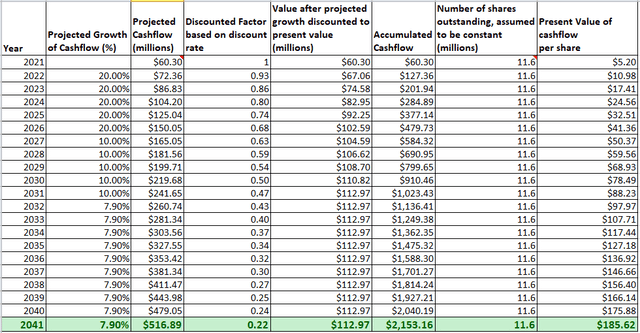

We will make the following assumption when evaluating the intrinsic value of the company:

- MED will grow at 20% for the next 5 years, based on the ‘EPS next 5Y’ growth value from Finviz.

- MED tapers in growth by half, therefore, growing at 10% from year 6 to year 10.

- MED matures in growth from year 11 to year 20, growing at 6.9%, the same as the latest US GDP growth rate.

- The value of free cash flow to be projected is $60.3 million, taken from the TTM period.

- The discount rate is estimated to be 7.9%.

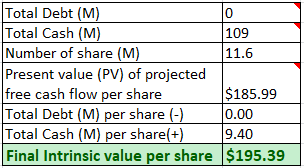

Based on the above inputs, the present value (PV) of projected free cash flow per share for MED is $185.62.

Author’s own calculation

Taking into account the total debt and cash that the company is holding, the final intrinsic value is $195.39.

The current price of around $180 implied the stock is currently slightly undervalued.

Investment Risks

MED is a “multi-level marketing (MLM)” company that inevitably incurs some negative stigma inherent in the MLM business. Some MLM companies turn out to be pyramid schemes.

To address this concern, the company stated in the latest annual report that:

- its “revenue is derived primarily from point of sale transactions executed over an e-commerce platform”

- “OPTAVIA Coaches do not handle or deliver merchandise to clients. This arrangement frees our OPTAVIA Coaches from having to manage inventory and allows them to maintain an arms-length transactional relationship while focusing their attention on support and encouragement.”

The points stated in the annual report emphasize that MED’s revenue is primarily derived from actual sales of its products and services to end customers rather than from recruiting new coaches. Coaches are also not required to make wholesale purchases of the company’s products to resell them to end customers. These are common practices of a pyramid scheme that the company has stated it is not involved in.

Investors should observe if the company is committed to maintaining such current practices as a legitimate MLM company in the long run.

Conclusions and Key Takeaway for Investors

MED’s coach-centric model of creating a network effect with coaches, clients, and its weight-loss products and services is a successful growth model as attested by its superior financial performance as compared to other peer companies. With this network effect to lock in customers, its stream of recurring subscription income should be sustainable in the long run.

The stock is currently undervalued and investors should take this as an opportunity to add a significant position and dollar cost average subsequently if the price were to retrace further.