2 Ugly Ducklings To Consider For Dividend Growth Portfolio

Table of Contents

sidneybernstein/E+ by using Getty Images

In some cases you arrive throughout a enterprise that appears to be like amazing at first glance. Anything would seem to be in spot. Rising earnings, rapid dividend growth, a dividend development record, lower credit card debt, very low payout ratios, reasonable development expectations, fundamentally all the things you want to see as a dividend expansion trader. But then you look beneath the hood and what you find can make you cringe a tiny.

Two businesses that usually give me pause when I’m screening dividend development shares are Medifast (MED) and Primerica (NYSE:PRI). I at last did initiate tiny positions in both at the commencing of this year, but I invested the improved part of the earlier two decades debating if I considered in the company’s futures. Both equally these providers have small business versions that make me “awkward.”

Nonetheless, I are unable to deny that all the metrics on these corporations search incredible. And that sooner or later received about my fear of proudly owning them. Properly, partially, at least, I can not convey myself to keep a comprehensive place on both. But I will lay out the details of equally and permit you come to a decision.

Medifast

From the Yahoo Finance internet site, right here is the summary of what Medifast does:

“Medifast, Inc., through its subsidiaries, manufactures and distributes weight reduction, bodyweight administration, healthier living goods, and other consumable health and fitness and nutritional products in the United States and the Asia-Pacific. The corporation delivers bars, bites, pretzels, puffs, cereal crunch, drinks, hearty possibilities, oatmeal, pancakes, pudding, soft serves, shakes, smoothies, comfortable bakes, and soups under the OPTAVIA, Optimal Well being by Just take Shape for Daily life, and Flavors of Household manufacturers. It marketplaces its solutions by means of point-of-sale transactions above eCommerce platform. The business was started in 1980 and is headquartered in Baltimore, Maryland.”

The business appears really promising in modern health-mindful planet from that description. Body weight loss is a colossal small business it looks every person is consistently dieting. So what is the dilemma?

The obstacle with investing in the enterprise is its enterprise product. It is an Multi-level marketing, multi-level advertising scheme. If you are unfamiliar with an Multi-level marketing, it is effectively a pyramid plan where by present members market and provide goods to new individuals and inspire them to do the exact same. Members are the internet marketing and gross sales drive. The dilemma with MLMs is that sooner or later, no just one is left to carry into the community, and the pyramid collapses.

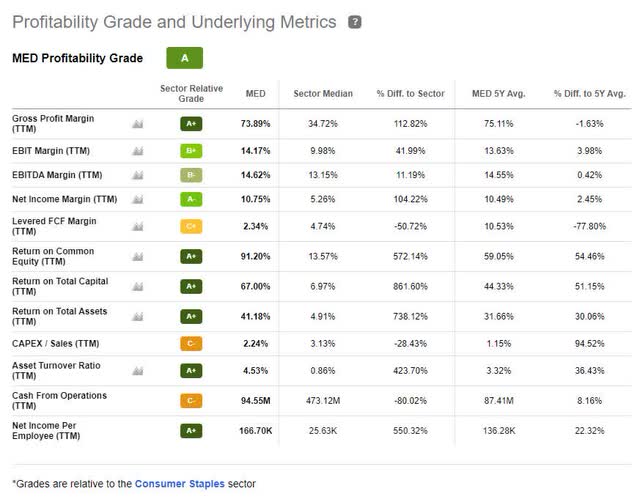

You will appreciate the financials and valuation if you can dwell with the enterprise product. In the below Fastgraph of Medifast, you can see that the enterprise is investing very well down below its historical norm. The chart also demonstrates the explosive development Medifast has seasoned and the important growth forecasted over the next few of decades. The business has a long-term growth target of 15% of course, administration is normally optimistic.

Medifast FASTgraph (fastgraphs.com)

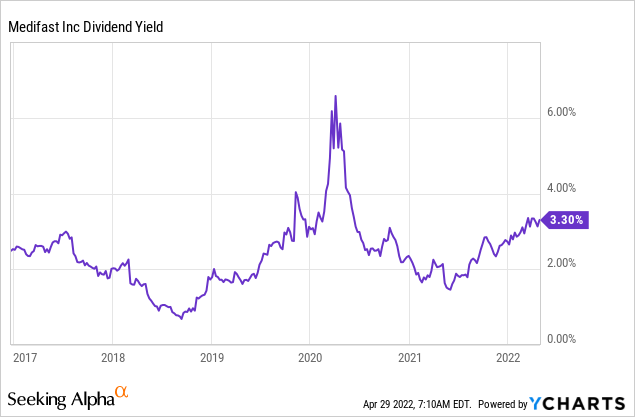

From the dividend growth aspect of factors, the corporation is exciting! The firm only has a seven-yr dividend advancement background On the other hand, it has experienced huge dividend progress. The three and 5-year dividend expansion costs are in excess of 40%, whilst this year’s boost was a gentle 15%. Nevertheless, a 15% expansion fee equates to doubling about each five years. If the firm hits its expansion targets, sustaining this fee should be attainable. When it is hard to use historic dividends to examine businesses with this sort of a shorter dividend background, present day setting up yield of 3.5% is the maximum produce ever presented, outside the house of the pandemic lows. The chart beneath reveals the dividend produce about the earlier seven several years.

Though the pandemic did tiny to gradual Medifast’s expansion, the present environment might be an additional tale. As inflation impacts the company’s items, it stays to be found how very well the corporation will be capable to pass these costs on. The organization added benefits from 90% of its revenue coming from subscriptions, but folks start to examine services when subscriptions improve. I think that above the future pair of several years, Medifast will have problems hitting its progress targets.

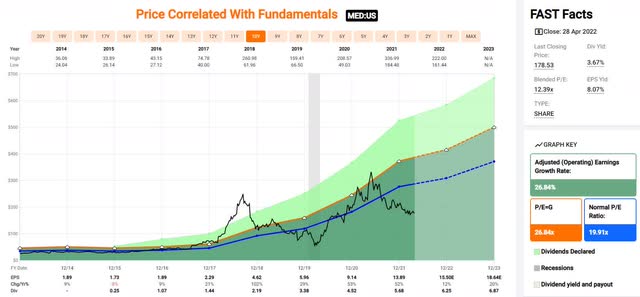

Below is a company with minimal credit card debt, speedy-escalating, and generates loads of money. In fact, the enterprise enjoys far better than 70% gain margins, as demonstrated in the table under. The enterprise carries quite minimal credit card debt and is not in a capital-intensive sector. At a PE of 11 and double-digit expansion, this enterprise is a clear deal in modern continue to overpriced current market. While every thing seems to be favourable for the company, I advise setting up a situation bit by bit as, in the quick time period, the street might not be as rosy as the financials would show. Nonetheless, present-day rates will establish to be a discount in the long run.

Primerica

A person knock on investing in insurance policies firms is the rather lower barrier to entry. Curiously, even with low barriers, it really is only in new a long time we have seen everyone obstacle the existing organization versions. Primerica is a person of these providers, and its stock can be punished for remaining different.

Primerica could effectively be regarded as an Multi-level marketing of insurance policy. Its clients also tend to become its agents. As of 2021, the firm had practically 130,000 independent accredited lifetime insurance plan associates. For comparison, Prudential (PRU) has 20,000 insurance plan brokers. To put this further more in point of view, Prudential collected about 27 situations the revenues of Primerica very last 12 months though the mix of goods comes into play, it is clear that Primerica operates in another way. Of course, just as most Medifast salespeople are not comprehensive-time, the broad the vast majority of Primerica brokers are section-time.

Just since Primerica is diverse does not indicate the company won’t accomplish. In excess of the past ten years, the enterprise has grown earnings for every share by an normal of 17% every year. Even though the earnings expansion has been spectacular, the operating money stream has been astounding. And as a dividend progress investor, dollars flows are considerable for the reason that, at the conclusion of the working day, dividends are compensated out of income flows. Primerica has accomplished a whopping 30% typical advancement in working cash circulation for every share in excess of the exact time period.

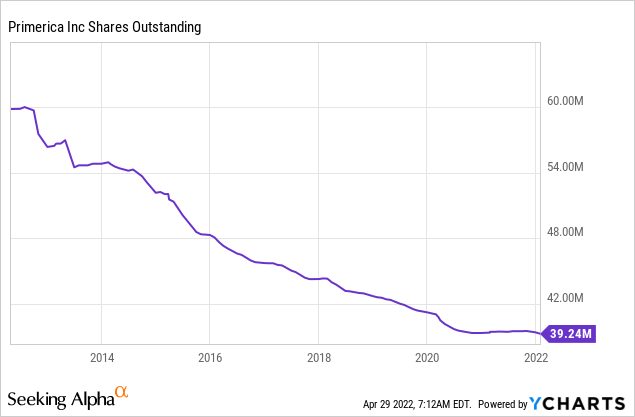

As opposed to its competition, Primerica does carry a increased credit card debt load relative to its dimensions. Nevertheless, this personal debt arrives with an A- S&P score. The firm on a regular basis buys back again its shares, and as a small-cap company, it doesn’t want huge greenback value buybacks to go the needle. Its recent approved buyback through the conclusion of 2022 is $325M, or virtually 6.5% of its industry cap. Extra importantly, the corporation would seem to get back again at affordable valuations, anything handful of businesses carry out. The chart below demonstrates the affect of buybacks about the final ten years.

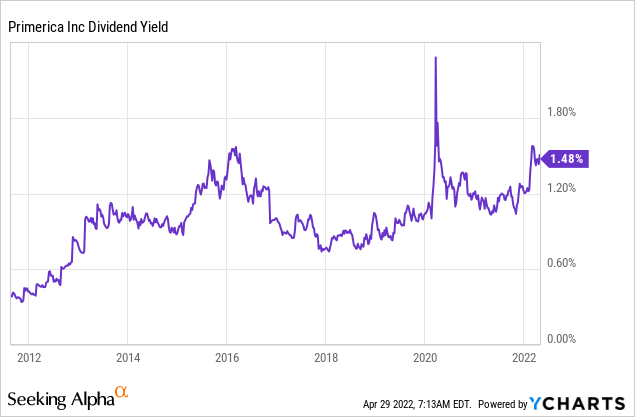

As a dividend expansion company, Primerica has been a rapid dividend grower. It has a few and five-year dividend advancement prices of about 20%. The most latest increase was a slower 17%, but at that price, the dividend would double about every 4 and a quarter yrs. Notably, the payout ratio is a paltry 16%, exactly where it has hovered for the previous decade. The potential to improve the dividend rapidly with out increasing the payout ratio is a indicator the firm’s dividend progress has home to proceed in the upcoming.

Primerica is not a major yielding enterprise. As demonstrated in the chart earlier mentioned, the recent produce of about 1.7% is the maximum produce it has ever available, other than for the flash crash in 2020, where it briefly topped 2%. The enterprise has averaged substantially closer to a 1% produce over the past 10 years, so present-day valuation is a important bargain primarily based on yield.

The Fastgraph below displays the relative undervaluation of Primerica currently dependent on PE ratios. The recent PE of significantly less than 11 is under the historic norm of 13.7, further more indicating that Primerica is in discount territory. Having said that, Primerica seems to be at an normal valuation relative to other insurance corporations. So an investor ought to contemplate the top quality of Primerica relative to its bigger friends prior to leaping in with both toes.

Primerica FASTgraph exhibiting relative undervaluation (fastgraphs.com)

Summary

The two Medifast and Primerica have abnormal business enterprise products. These providers are hugely financially rewarding and have histories of increasing their dividends. Importantly, by any measure, these firms have proven the ability to enhance their dividends speedily. With reduced payout ratios and double-digit advancement forecasts, they really should go on accomplishing so into the long term.

At this time, the two providers look like amazing bargains in contrast to their historic PEs and dividend yields. Nevertheless, Primerica’s PE is in line with its rivals at this time, even although all its metrics suggest it is a bargain. I am at this time incorporating to both but accomplishing so cautiously, given the all round state of the market place.